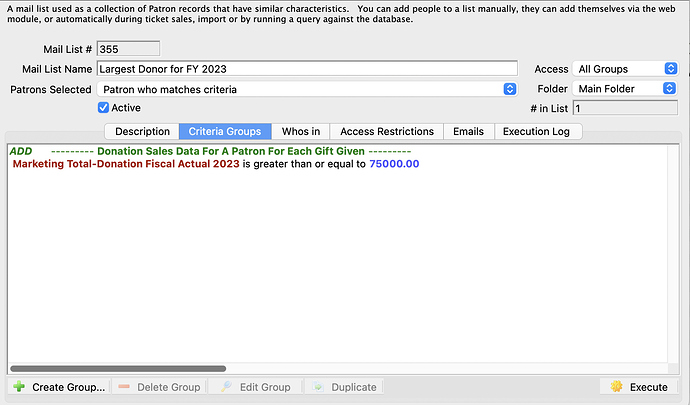

1. Largest Donors This Fiscal Year

Looking to find who your largest donors are for this fiscal year? Using the Marketing Total - Donation Fiscal Actual Year field provides a cumulative total of all gifts given to any campaign in a particular fiscal year. Combining this field with a target dollar value within a Mail List or even Report criteria will point you right to these generous donors.

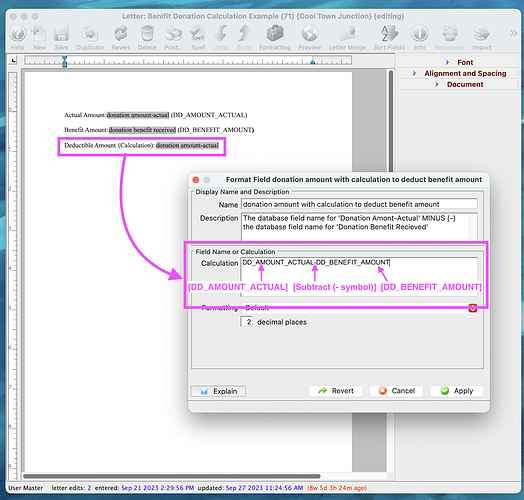

2. Adding a Calculation Containing One or More Fields Inserted Into a Form Letter

Inserting multiple database fields can be used in the Calculation field of a Form Letter to display the total amount resulting from those multiple fields. Using basic math calculations between two inserted database fields will automatically calculate the sum of the equation on the form letter.

Here’s an example of a helpful way your development team could use this feature when including the Donation Amount with the Benefit Amount deducted from it in a Form Letter. The Donation Amount-Actual field can be edited to subtract the Donation Benefit Received field in the Formatting Field Window to insert the Deductible Amount value.

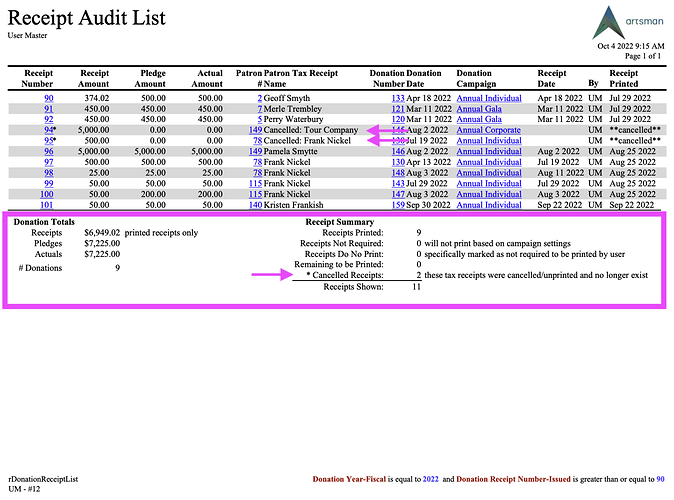

3. Tracking Cancelled Tax Receipts - Audit List-Receipts Report

Sometimes it is necessary to officially Cancel a Tax Receipt. For example, after the Tax Receipt was mailed to the donor, they request another one be sent because they lost the original. While the donation is still valid, the first Tax Receipt needs to be “Cancelled” and a new receipt issued.

To help track this information, the Audit List-Receipts report displays each Tax Receipt status with the corresponding donation. Clients have found this report most useful when reporting charitable revenue to governments, foundations, and auditors.