We are coming up to the end of the year and the time for issuing tax receipts for donations. We’ve had a number of questions lately on this topic and thought that we would provide you with a couple of tax receipt topics this week. We also have an update on 64 bit Theatre Manager.

Please check out our webpage on Donation Tax Receipt Options for more information on issuing donation receipts.

1. Issuing Tax Receipts in Canada

There are some rule changes for issuing tax receipts in Canada.

There is an important notice that Revenue Canada’s website must be included and that it has changed. The new website must be on your charitable receipts by March 31, 2019.

2. Whose Name Goes on a Tax Receipt?

It is important to identify the true donor when entering donations into Theatre Manager to make sure you are in legal compliance.

Please check our help page on this topic for links and guidelines to assist you.

IRS Publication 1771 for the US also has rules regarding tax receipts and deductibility of non-receiptable benefits.

3. 64 Bit Theatre Manager - A Status Update**

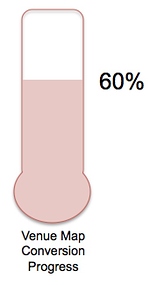

Some asked us if the 32 bit version of Theatre Manager stops working on January 1, 2019. The short answer is no – rest assured, TM will keep on working like it always has.While many are using 64 bit, the key step to the migration is reviewing your box office maps. We suggest installing TM 64 bit on one workstation and looking at them. If they are a little askew, this web page describes how to quickly adjust the maps for the box office (pick your own seats online are not affected).

Throughout the holidays and well into January, we will help people who need assistance with the minor adjustment to the maps. Only when everybody’s maps are good, will the migration process be done .