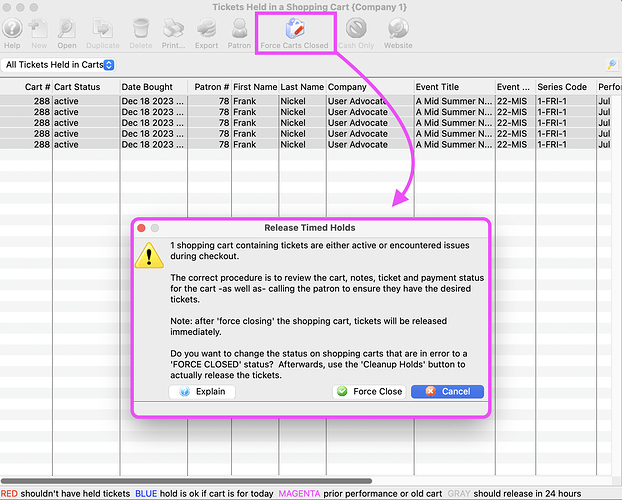

1. Force Close Web Carts Online

Open carts can be managed from the Manage Current Internet Holds window. This includes Force Closing active or expired carts. Use caution when manually closing carts as active carts belong to patrons currently navigating the ticketing site.

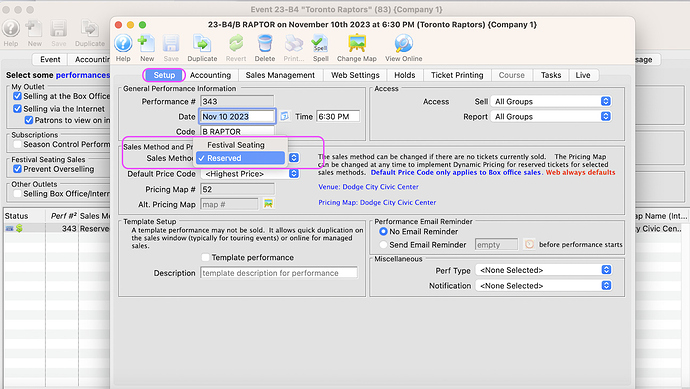

2. Changing a Performance From Reserved to General Admission

Transitioning from Reserved to General Admission seating event may be necessary due to unforeseen changes required for the event or one or more performances. You can change the Sales Method of the performance from Reserved to General Admission while tickets are currently on sale or have already been sold. The reverse is not feasible as Theatre Manager would not know how to prioritize and seat patrons within the venue.

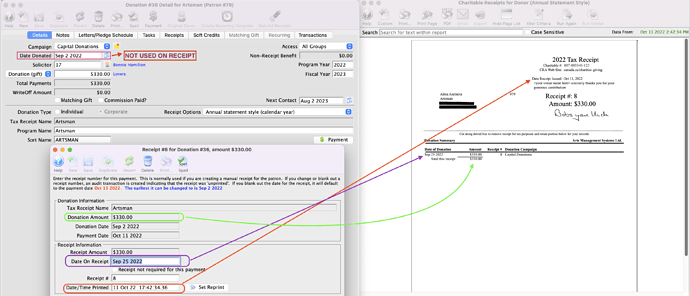

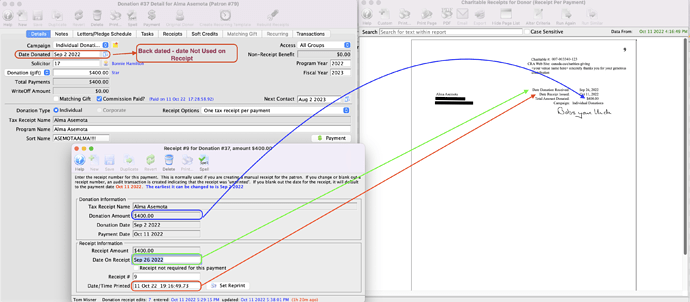

3. Tax Receipt - Back Dating Date on Receipt

There are times a donation receipt may need to be back-dated if we want to recognize the contribution in a prior fiscal or calendar year.

A classic example is during the extended holiday break when the office is closed at the end of December. Upon reopening the office in January of the new calendar year, 3 cheques arrived which were postmarked prior to Dec 31st. These donations need to be entered and the payments deposited in Theatre Manager.

Since these patrons are expecting a tax receipt with the previous year’s date, the donation can be backdated to match the date the cheque was written or postmarked. Theatre Manager also allows you to edit the receipt dates for the donation.

Annual Style Tax Receipt

One Per Payment Style Tax Receipt