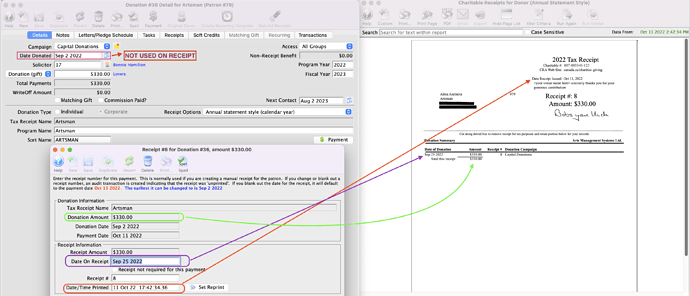

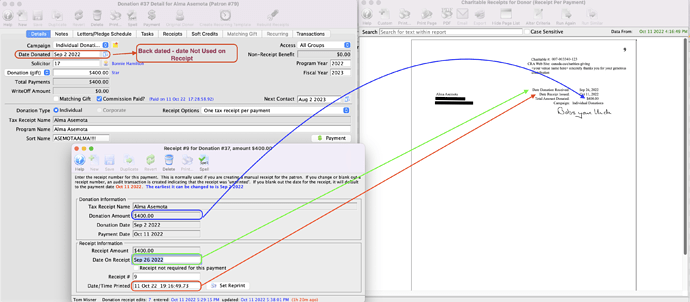

1. Tax Receipt - Back Dating Date on Receipt

There are times a donation receipt may need to be back-dated if we want to recognize the contribution in a prior fiscal or calendar year.

A classic example is during the extended holiday break when the office is closed at the end of December. Upon reopening the office in January of the new calendar year, 3 cheques arrived which were postmarked prior to Dec 31st. These donations need to be entered and the payments deposited in Theatre Manager.

Since these patrons are expecting a tax receipt with the previous year’s date, the donation can be backdated to match the date the cheque was written or postmarked. Theatre Manager also allows you to edit the receipt dates for the donation.

Annual Style Tax Receipt

One Per Payment Style Tax Receipt

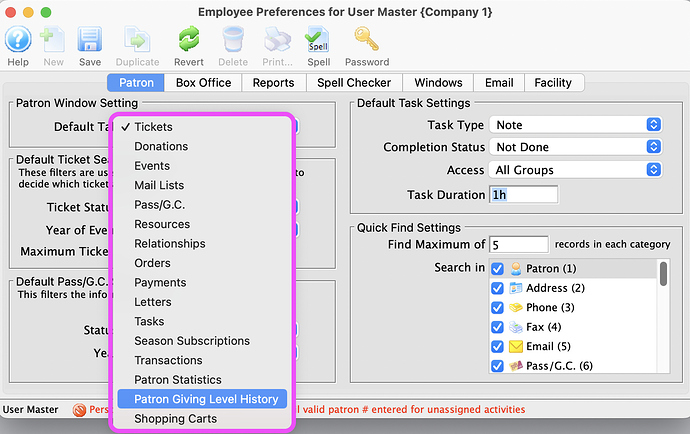

2. Changing Your Default Tab in the Patron Record

When opening up a Patron Record, employees can change the default tab (Tickets), to any of the other tabs listed across the middle of the Patron Record. Development personnel might appreciate opening directly to the Donation or Patron Giving Level History tab. You can change the Default Tab settings, along with other options in Employee Preferences Settings.

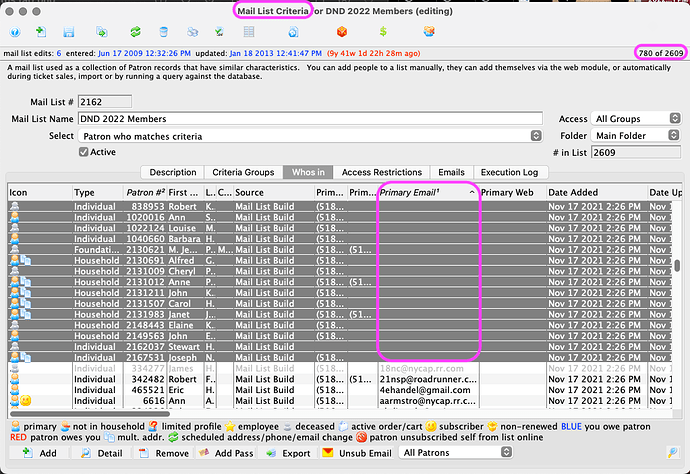

3. Status Bar Subtotalling Example - Record Count in a Mail List

Theatre Manager’s Window Status Bar provides fast access to your data with its built-in subtotalling feature. In a Mail List’s Who’s In tab, try sorting by Primary Email and selecting the empty rows to see how many patrons don’t have an email address:

By default, the location of this Window Status Bar is the bottom of each window. Try moving it to the top in your employee preferences to keep this subtotalling functionality top of mind!